Commodity Loan/ Lease Explained

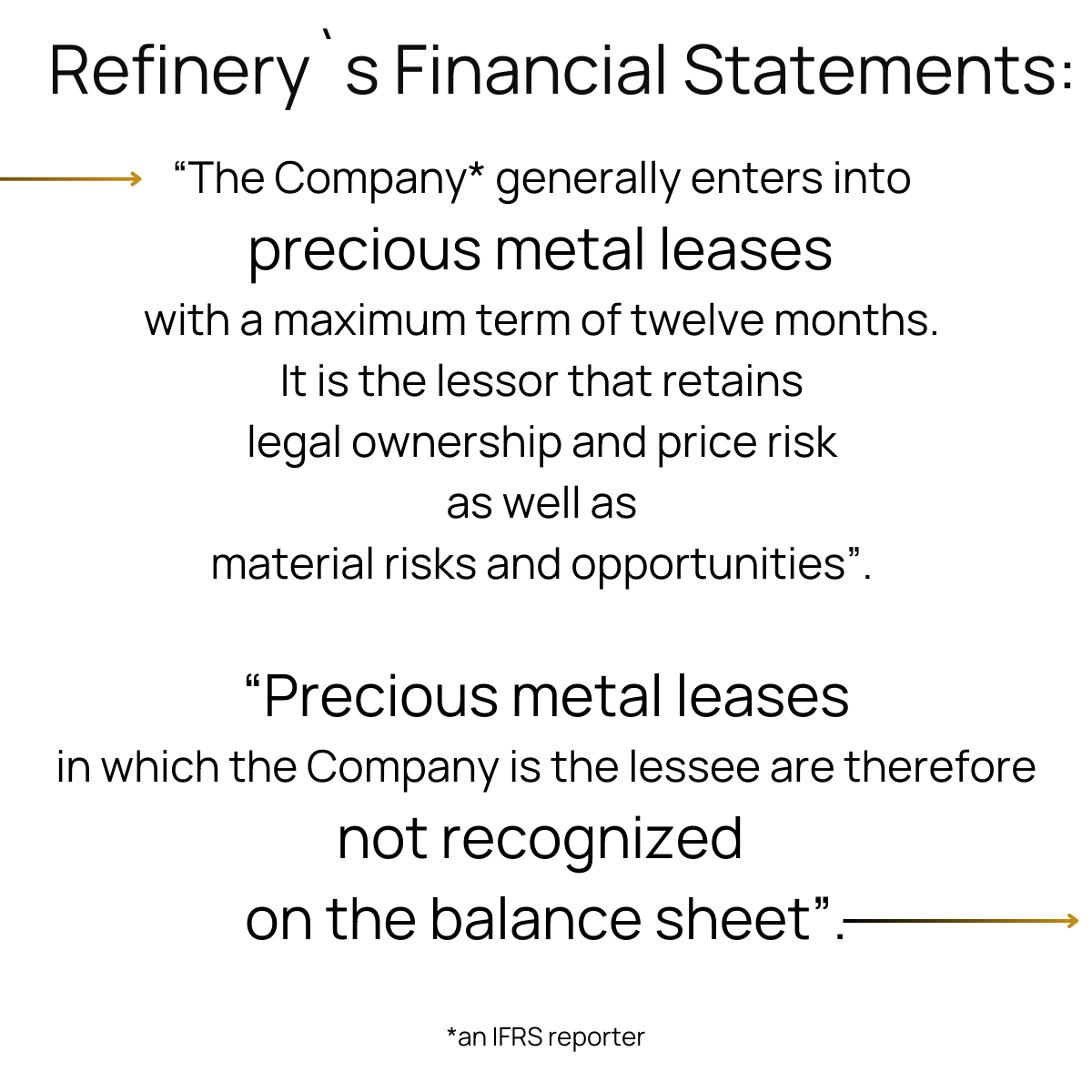

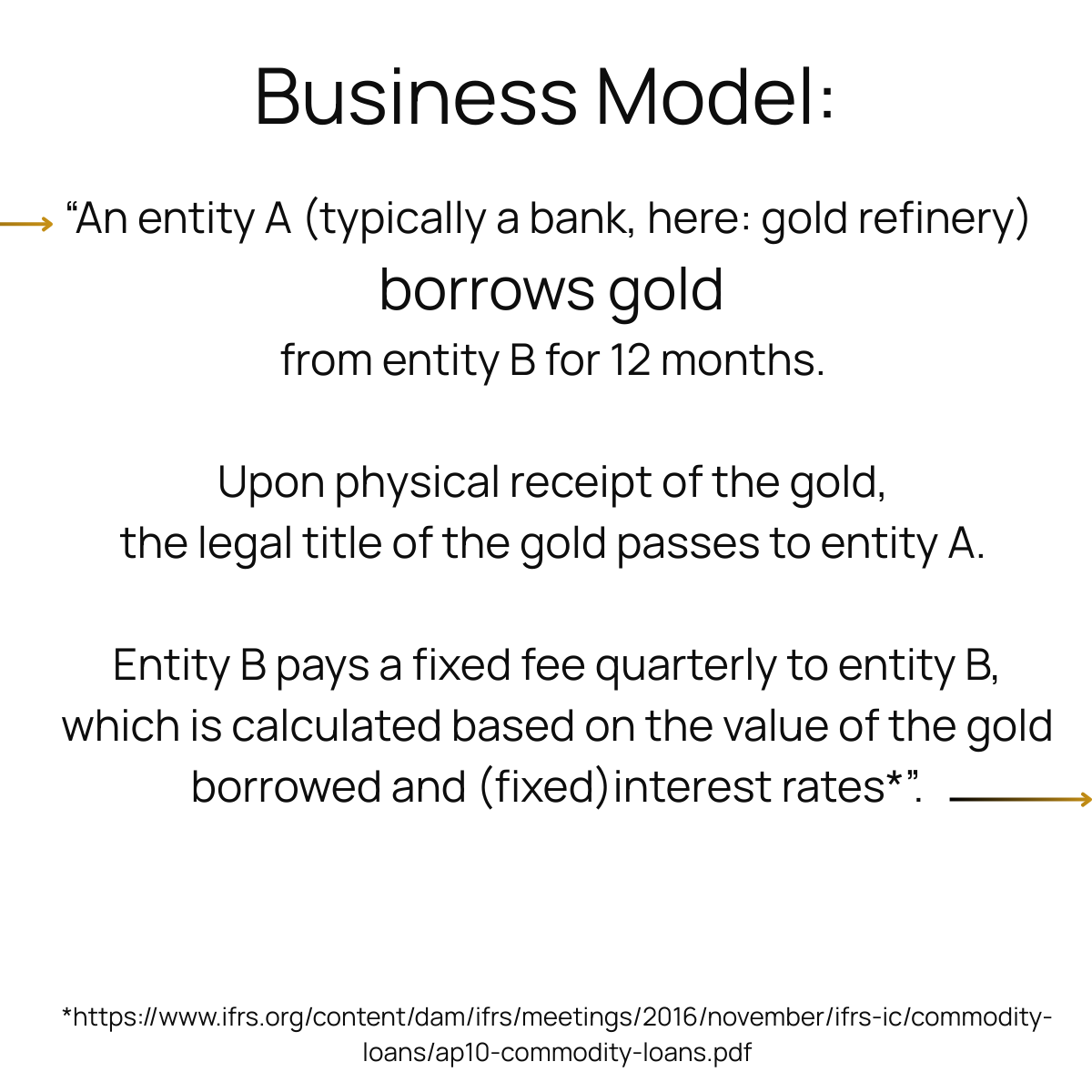

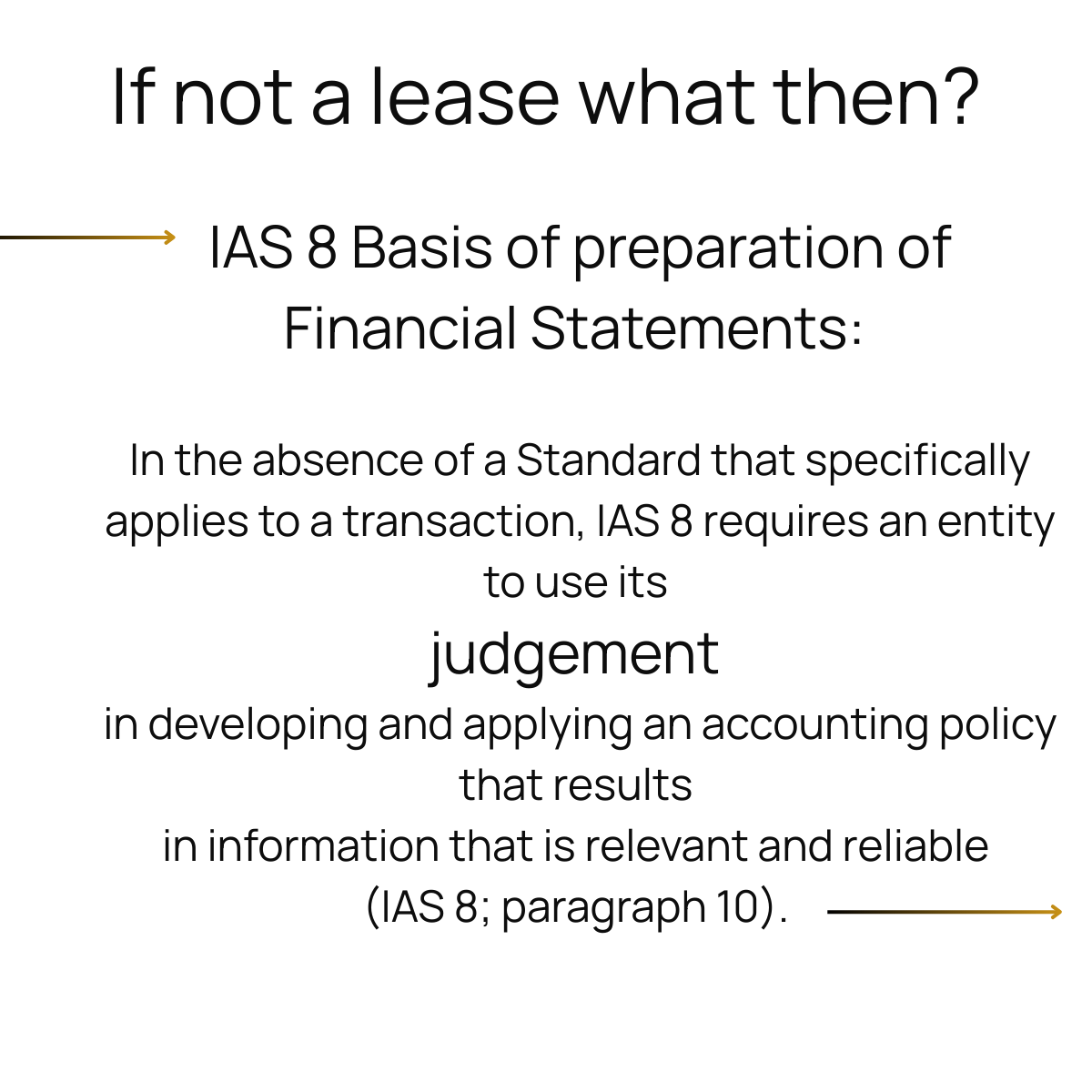

In the absence of a Standard that specifically applies to a transaction, IAS 8 requires an entity to use its judgement in developing and applying an accounting policy

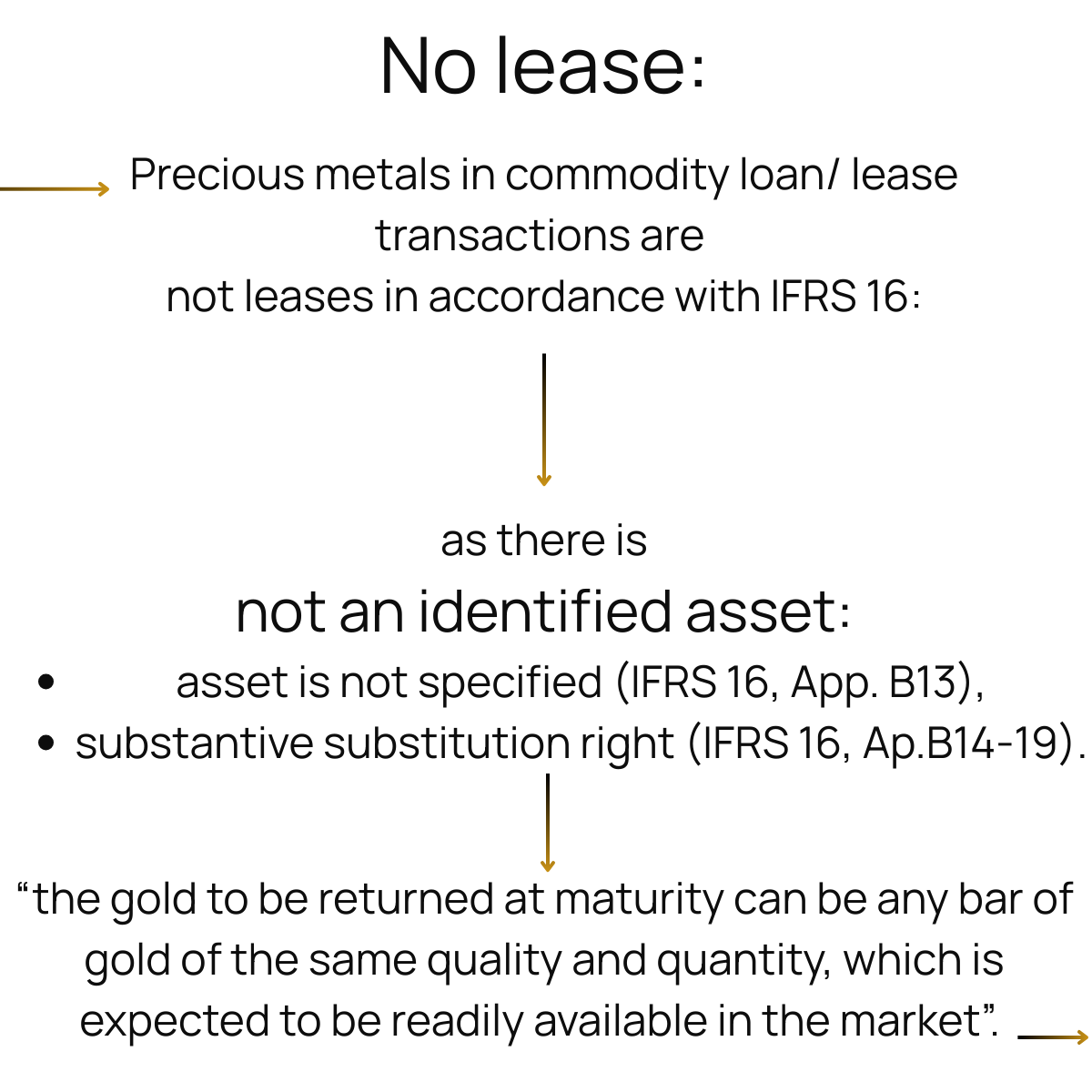

A lease, or not a lease, that is the question.

Leases accounted for as services in the past (you might check my "Off balance sheet" post)

or

Leases that are none?

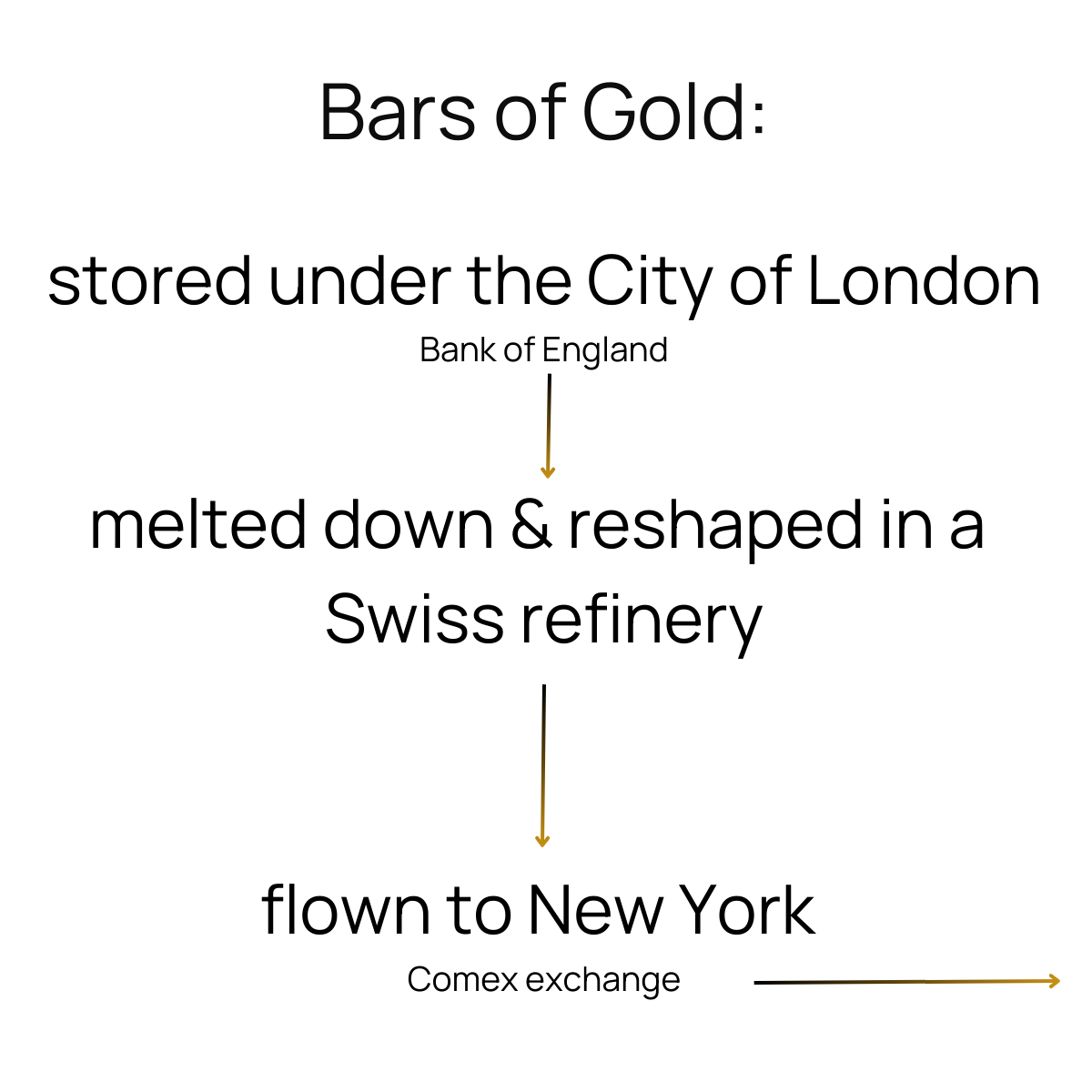

I came across an interesting article on frenzied activity concerning returning bars of gold from Europe (UK) to the US.

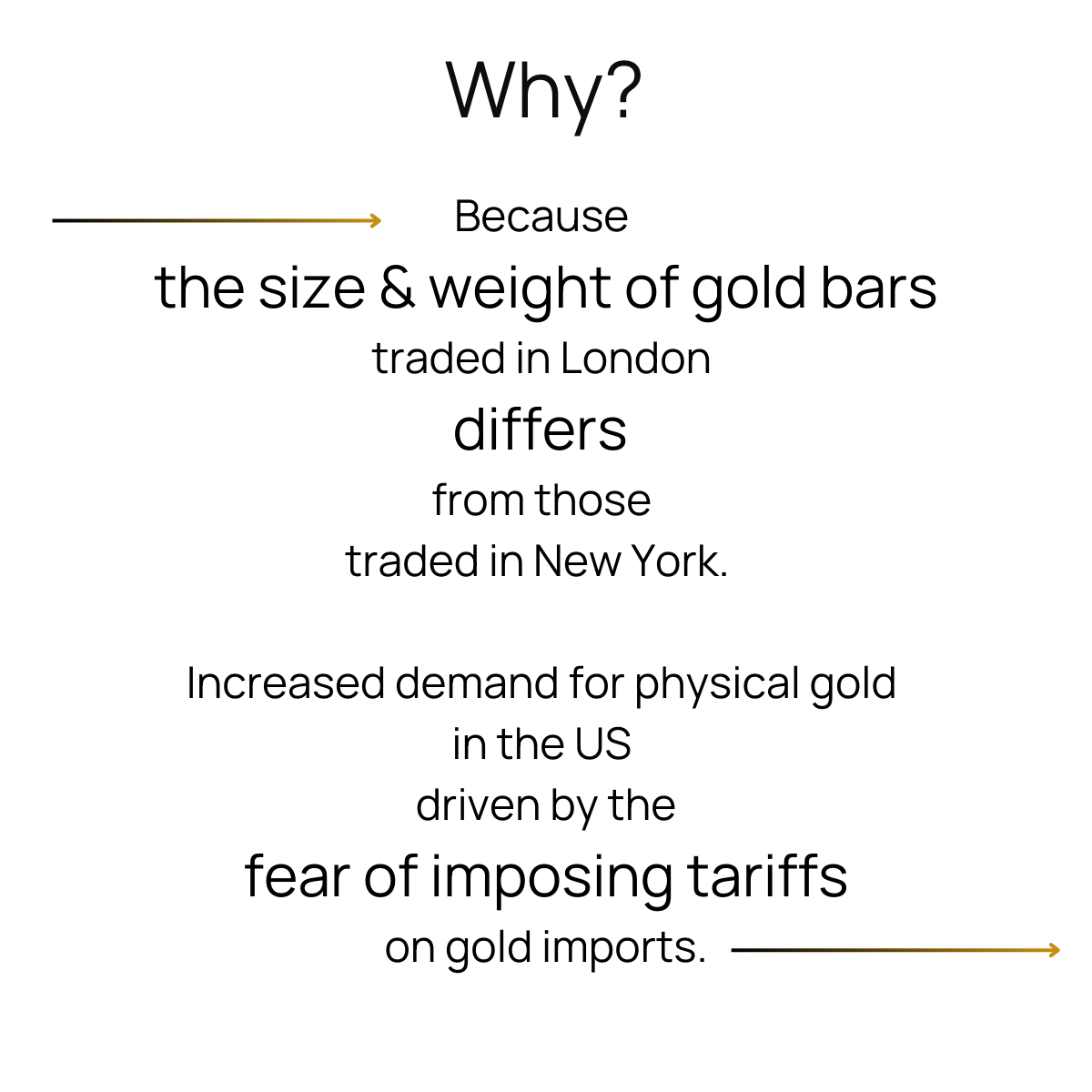

All motivated by tariffs or rather, possible threat of them.

I also learned that bars of physical gold are not created equal* (at least for the holders in the Europe vs. those in the US).

Just one thing to remember:

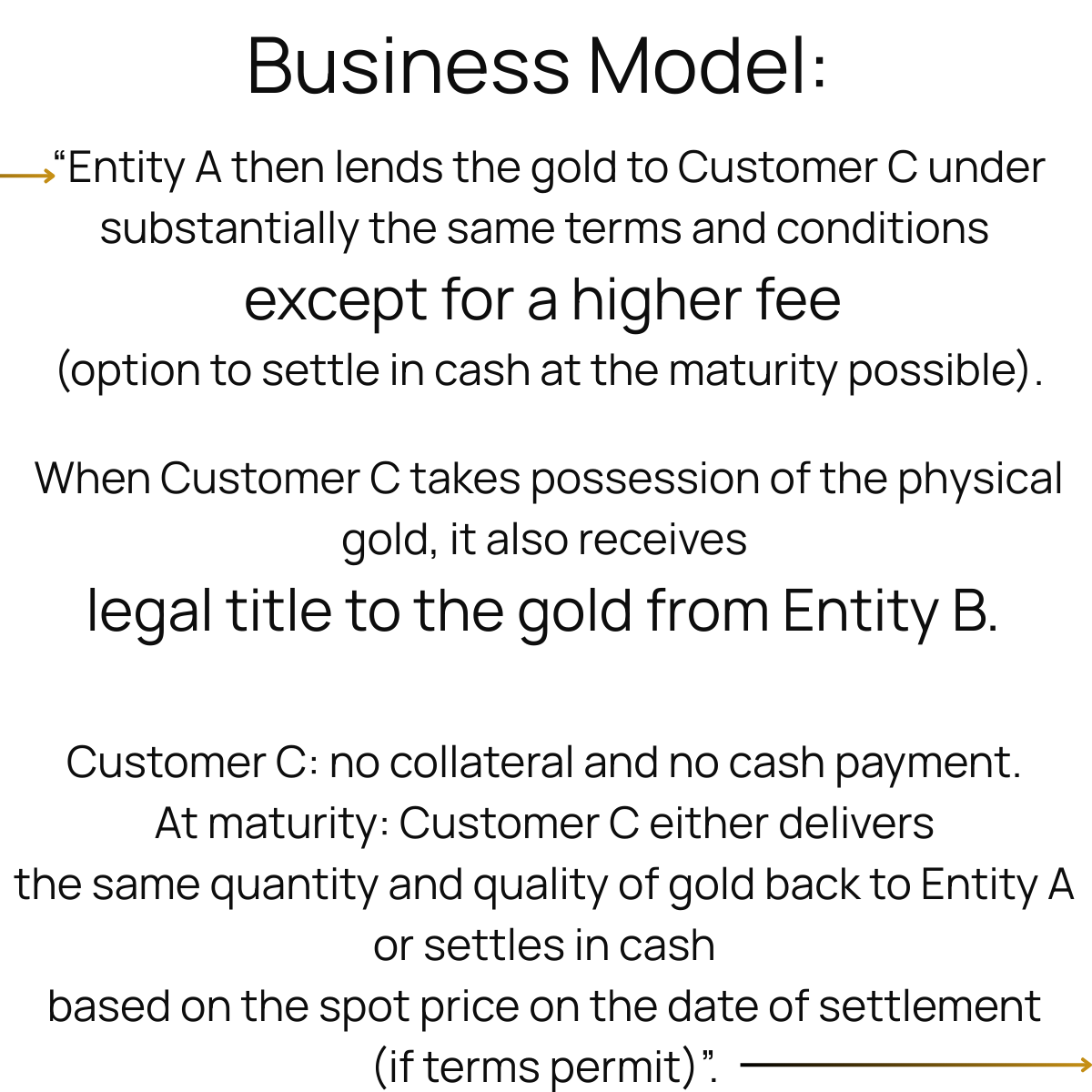

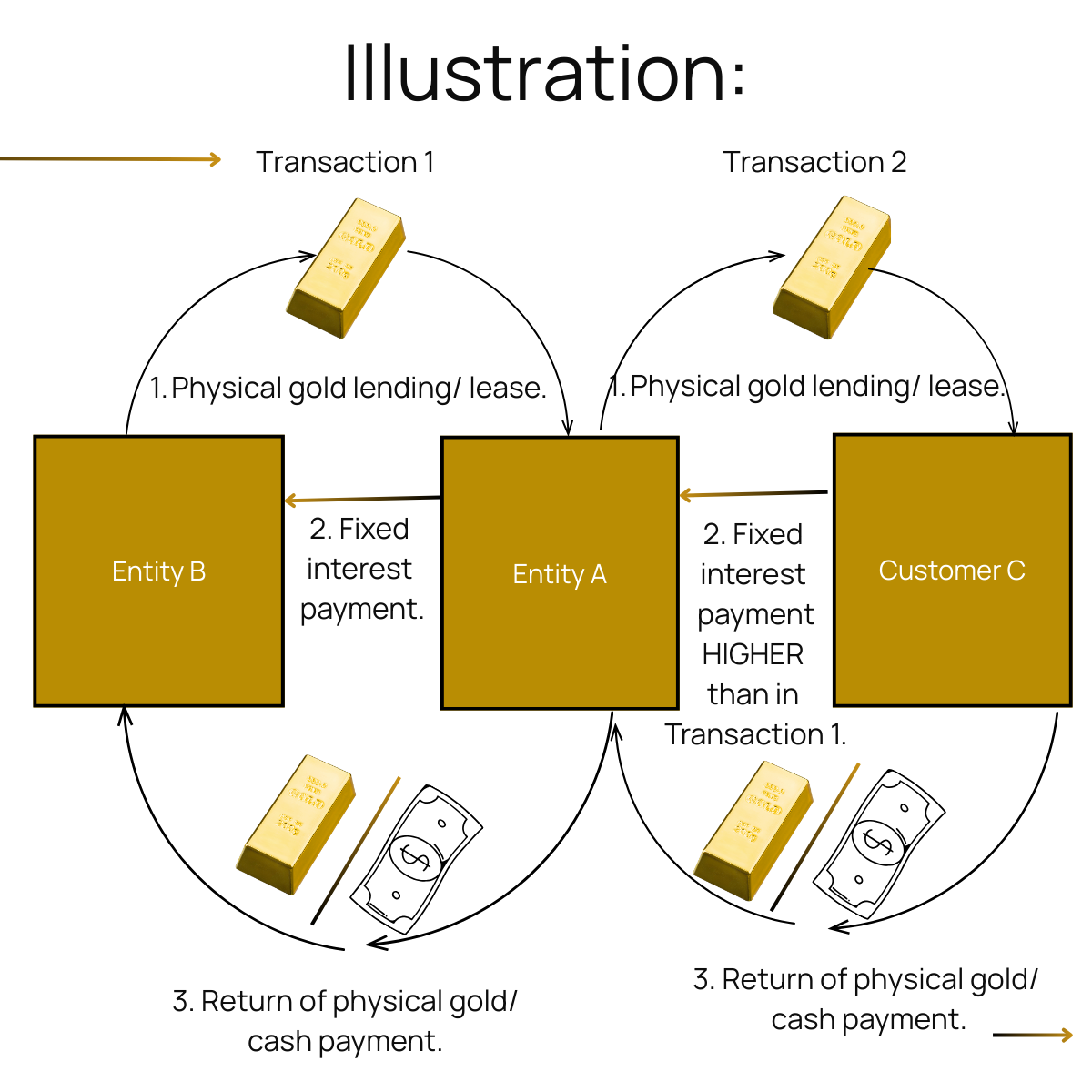

Legal title /formal ownership is NEVER a single determining factor on whether an underlying contract contains a lease or not.

Look instead for:

▫️an identified asset (IFRS 16. B13-B20),

▫️the right to obtain substantively all benefits from use (IFRS 16. B21-B23) and

▫️the right to direct the use of an asset (IFRS 16. B24-B30).

Go through the slides to learn more ⏩.

Standard for bars of gold (physical assets) are defined by the London Bullion Market Association (LBMA) in London.

A “standard” gold bar weighs approximately 400 troy ounces (12 kg) and has a minimum fineness of 995 parts per 1,000 pure gold (99.5% purity).

Credits:

Of course, "my" quote was inspired by Hamlet, Act III, Scene I (To be, or not to be) by William Shakespeare.

This post is based on information from an article published in the Financial Times on March 14th, 2025/ Copyright Leslie Hook and on SRF radio news.