Determination of main business activity in accordance with IFRS 18

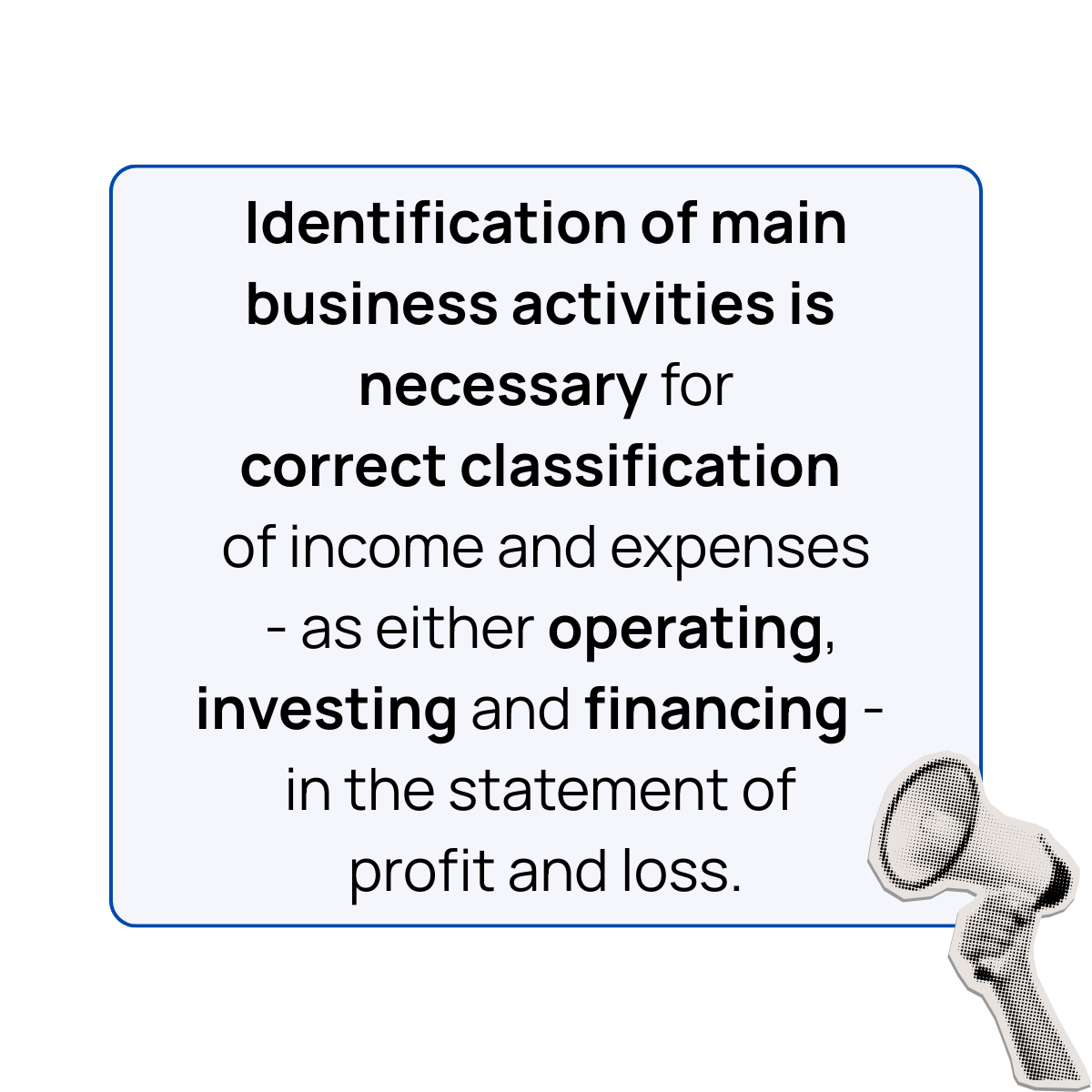

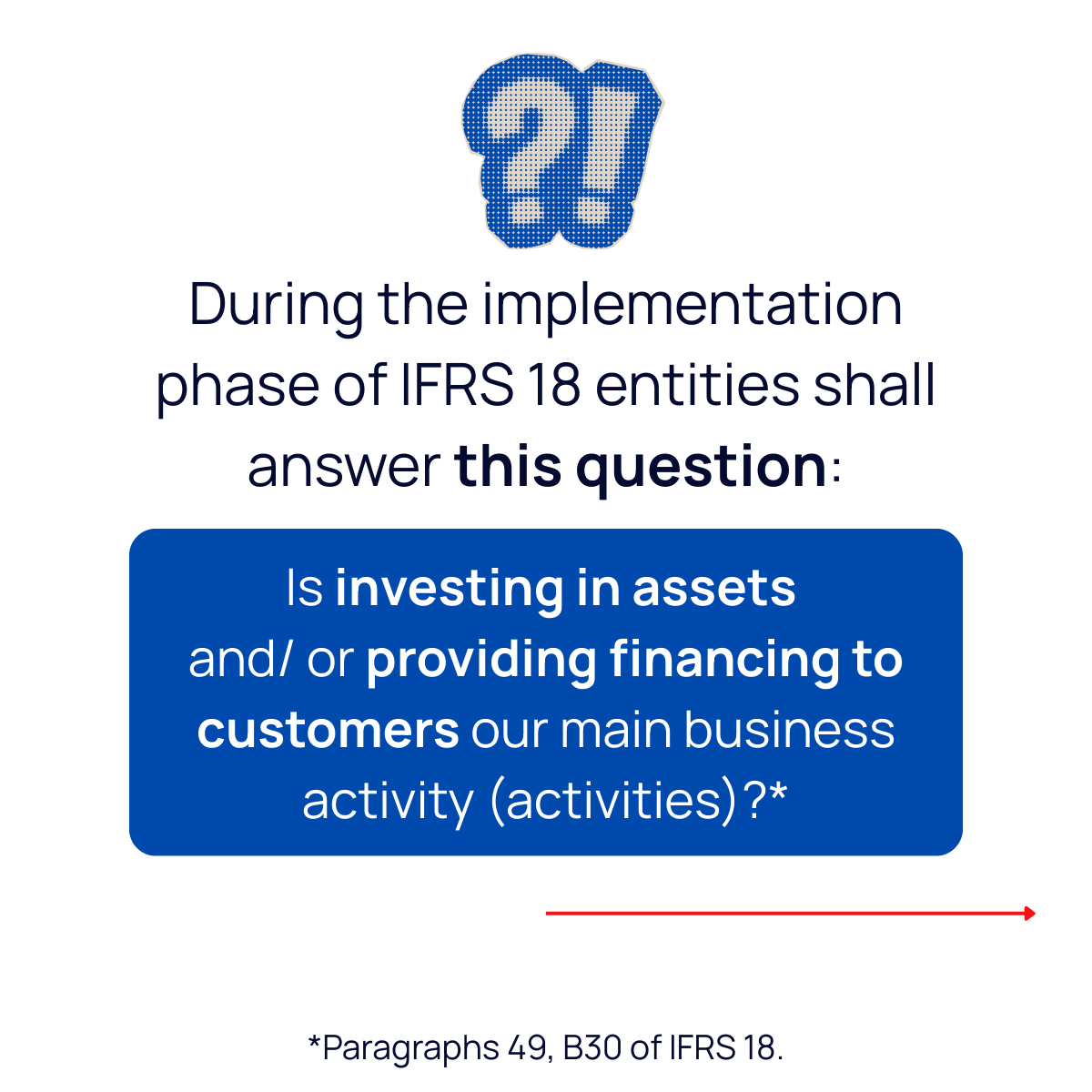

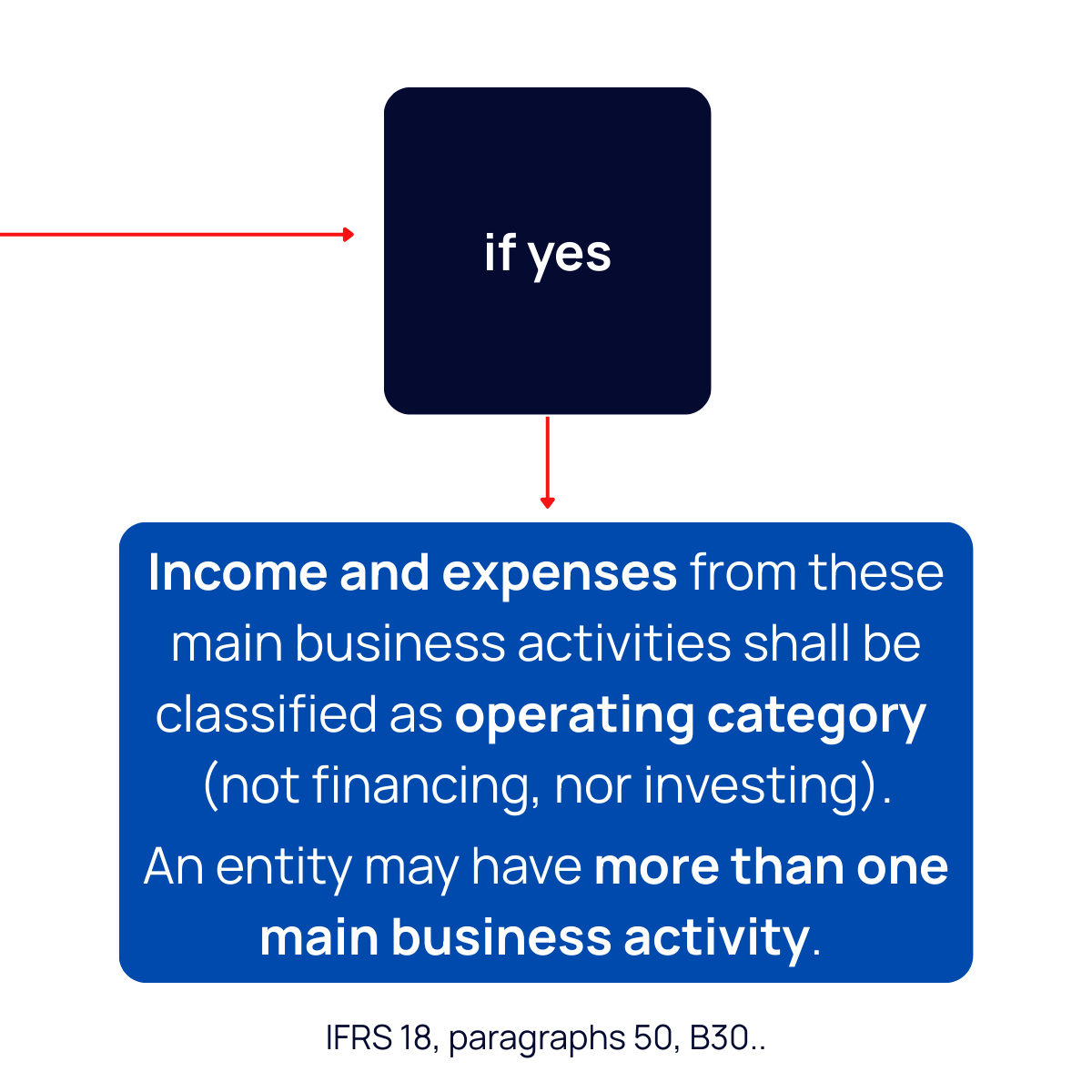

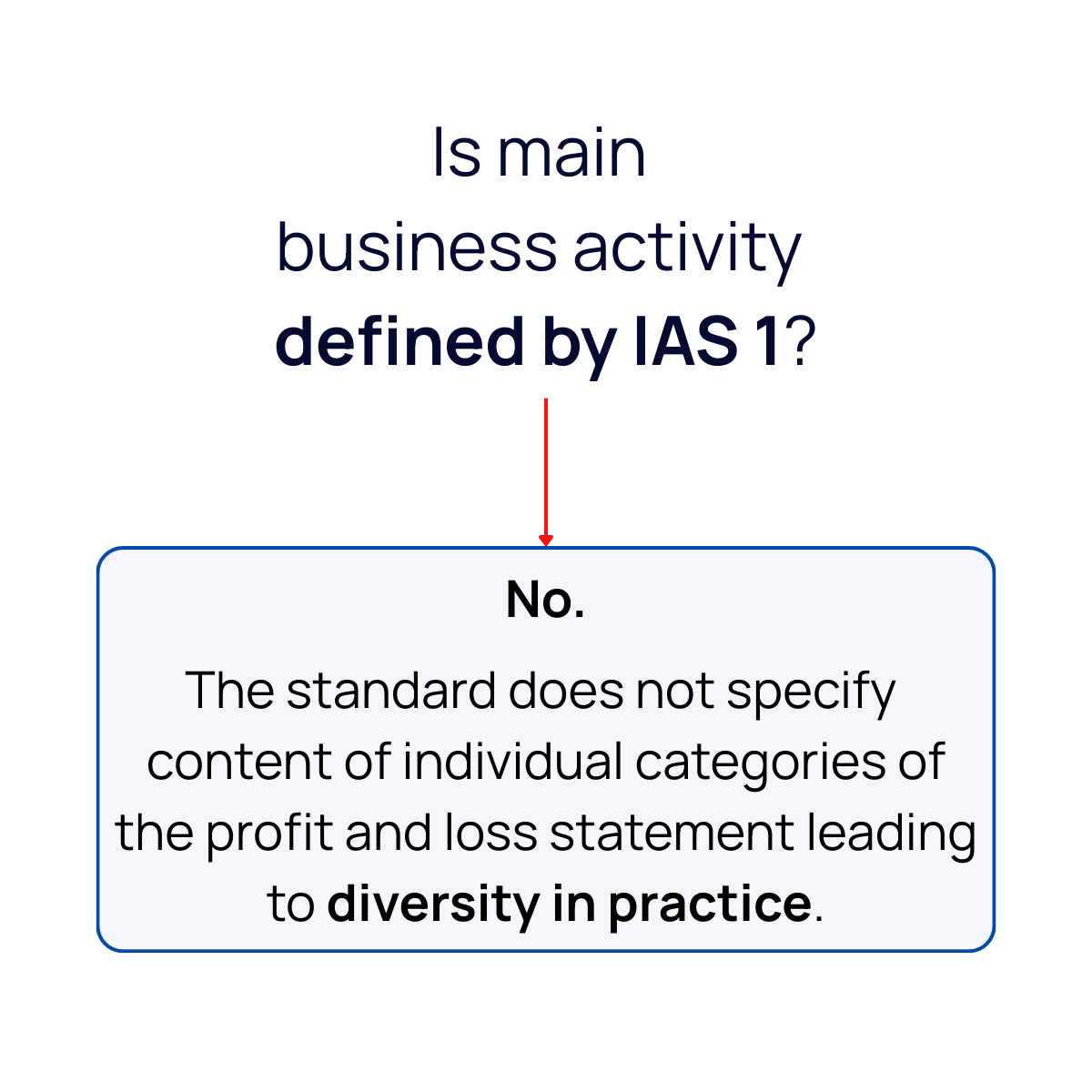

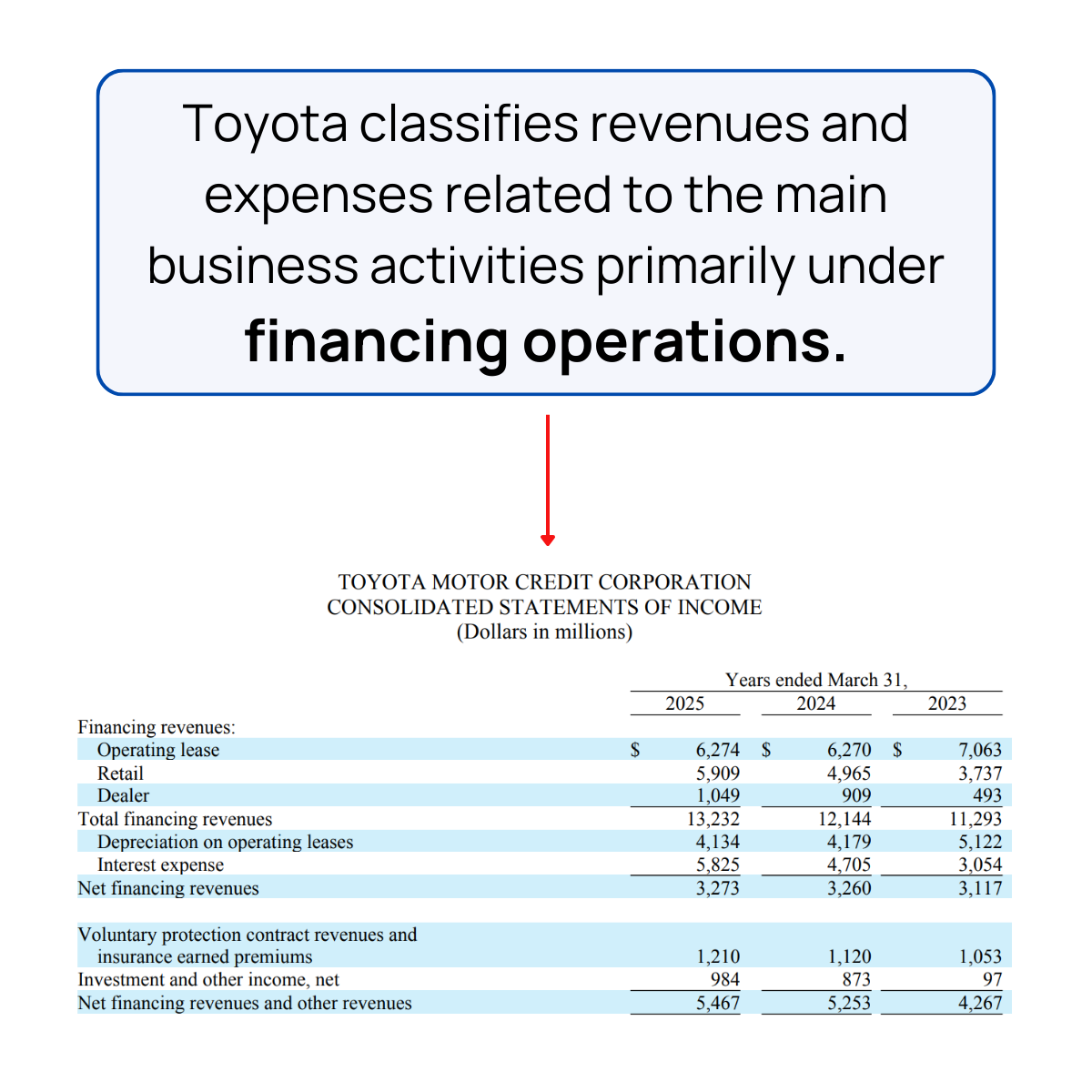

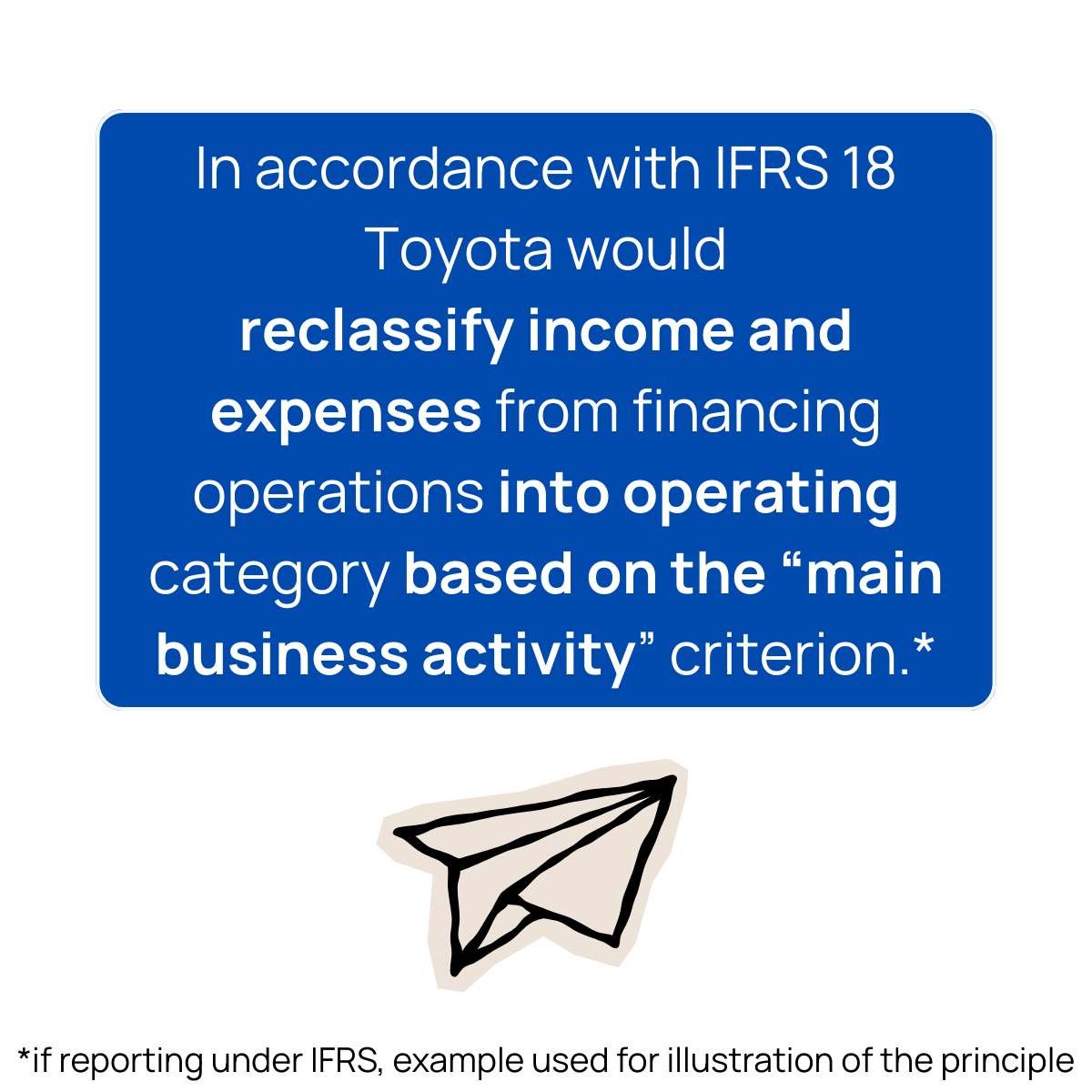

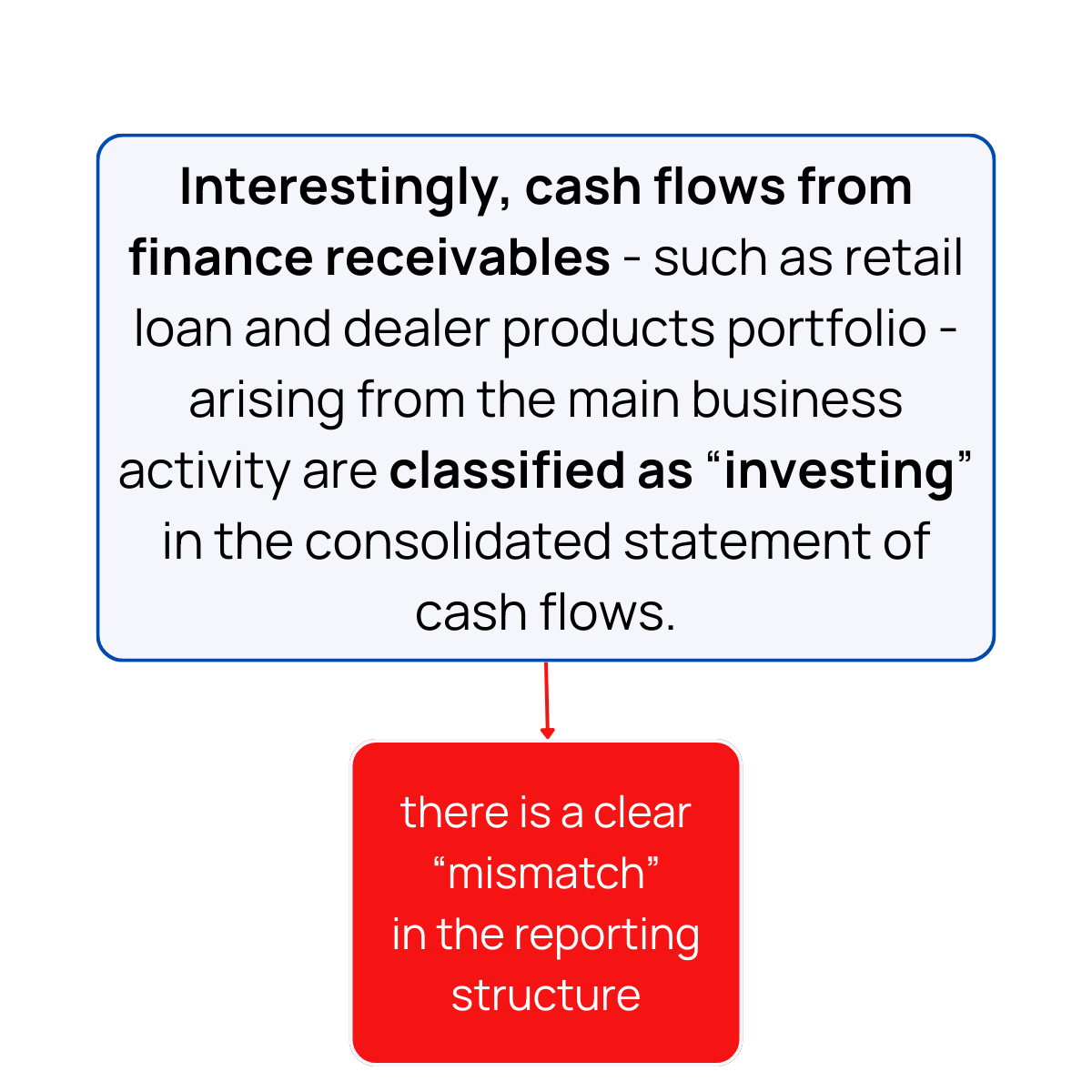

Identification of main business activities is necessary for correct classification of income and expenses - as either operating, investing and financing - in the statement of profit and loss.

“The goal shouldn’t be to make the perfect decision every time but to make less bad decisions than everyone else.”

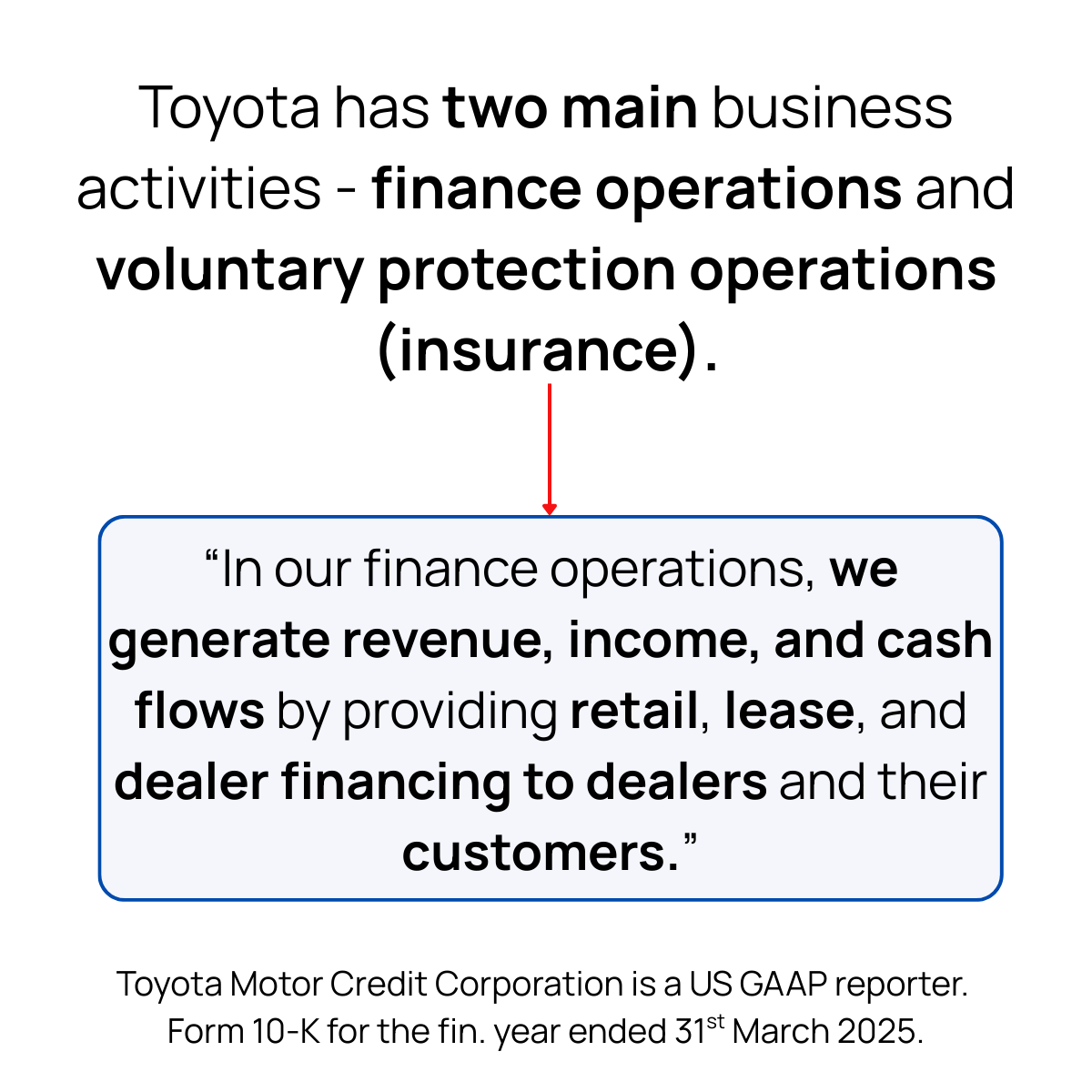

Today I am writing about main business activities and why their determination matters for entities in light of the upcoming IFRS 18.

Decisions concerning main business activities may significantly change profit and loss structure of entity's financial report and will impact:

🔹 Performance measures,

🔹Allocation of resources,

🔹External message to investors.

Judgement on main business activity must be conducted with care (and be backed by evidence).

Time perspective is important. Businesses shall adapt to the dynamic environment - in terms of financial reporting and others - rather than preserving 'status quo.'

Take a short look at a simple summary + tips in the carousel.

headline quote by Spencer Fraseur, The Irrational Mind: How To Fight Back Against The Hidden Forces That Affect Our Decision Making via Goodreads.