IFRS 13 Fair Value Measurement

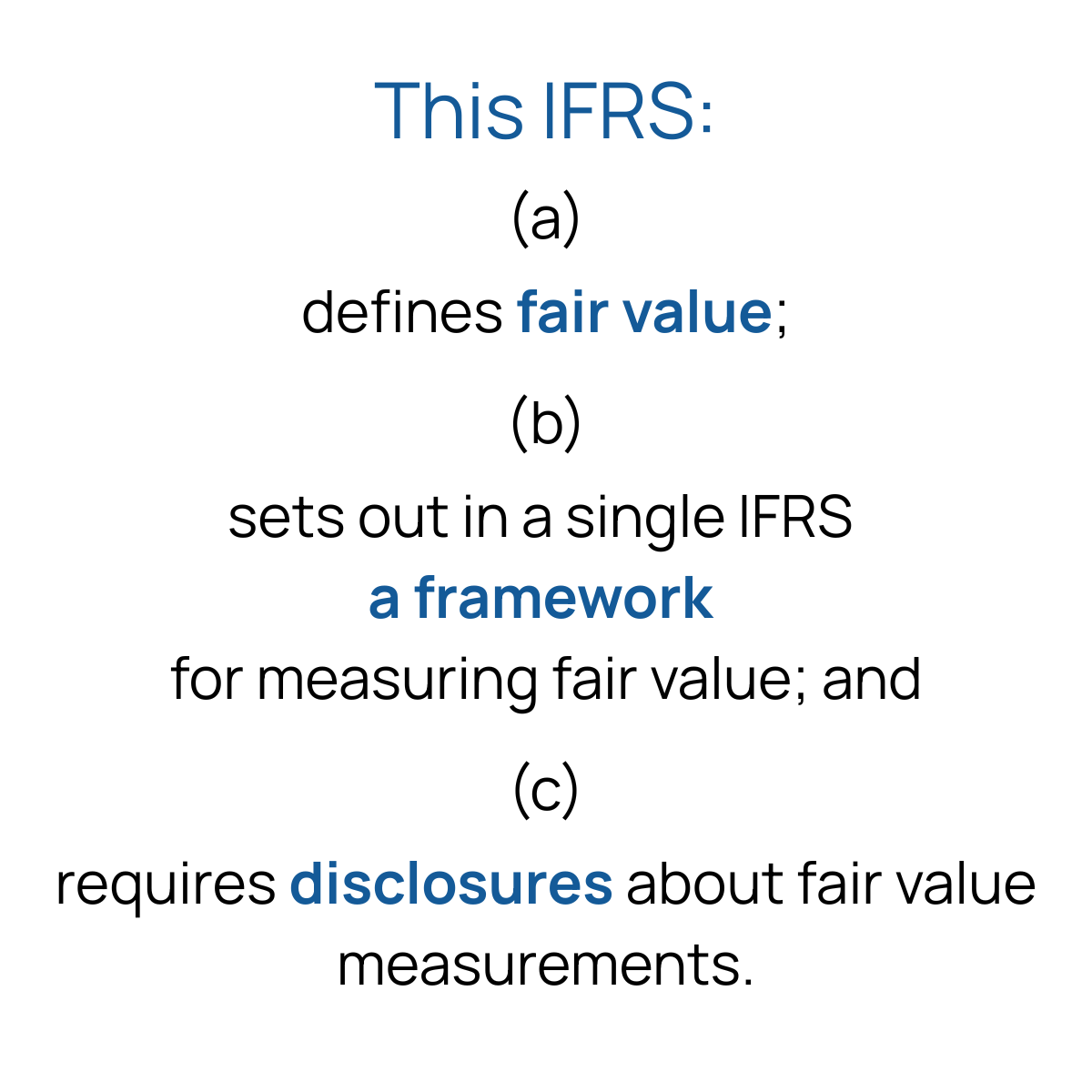

This standard defines fair value; sets out in a single IFRS a framework for measuring fair value; and requires disclosures about fair value measurements.

“The number one reason people lose money in investing is because they buy assets without giving any thought whatsoever to the fair value.”

If you've invested into a debt backed by the River Quest property in Paris, chances are you are gonna lose some money.

Originally triple A-rated financial instruments - commercial mortgages - are in trouble.

The trouble is approximately Є168 m big which is by how much the fair value of the building dropped in over two years.

The office building is 80% occupied by the IT service provider Atos.

Reasons behind?

▫️ The market might have been overheated in Paris.

▫️ Hard to find tenants for office space in the post-covid, work-from-home era.

Check out more on the topic of fair value with real world examples in the slideshow.

You will receive a decent fair value for the 15 seconds of your time, I promise.

The opening quote is from Naved Abdali, Author of INVESTING - HOPES, HYPES, & HEARTBREAKS : THE GAME IS RIGGED AND IS RIGGED IN YOUR FAVOR via Goodreads.

Article sourced from FT/ Commercial property, written by Euan Healy.