IFRS 12 Disclosure of Interests in Other Entities

An entity discloses information concerning the nature of, and risks associated with, its interests in other entities; and the effects of those interests on its financial position, financial performance and cash flows.

Keiretsu (Japanese: 系列; literally system, series, grouping of enterprises, order of succession) is a set of companies with interlocking business relationships and shareholdings that dominated the Japanese economy in the second half of the 20th century.

I came across the recent article about Toyota's move to simplify the cross-shareholdings, characterical for Japanese post-war economy.

As Financial Times reports, Toyota Industries, the sister company of Toyota Motors AND its key supplier ( ⏩ more on the complexity in the carousel) shall be bought in a take-private proposal.

Toyota Motors' chair, Mr. Toyoda, invests personal money into the takeover of Toyota Industries which shall be held by:

🔹 A special-purpose company backed by the Toyota Motors and another Toyota Group Company.

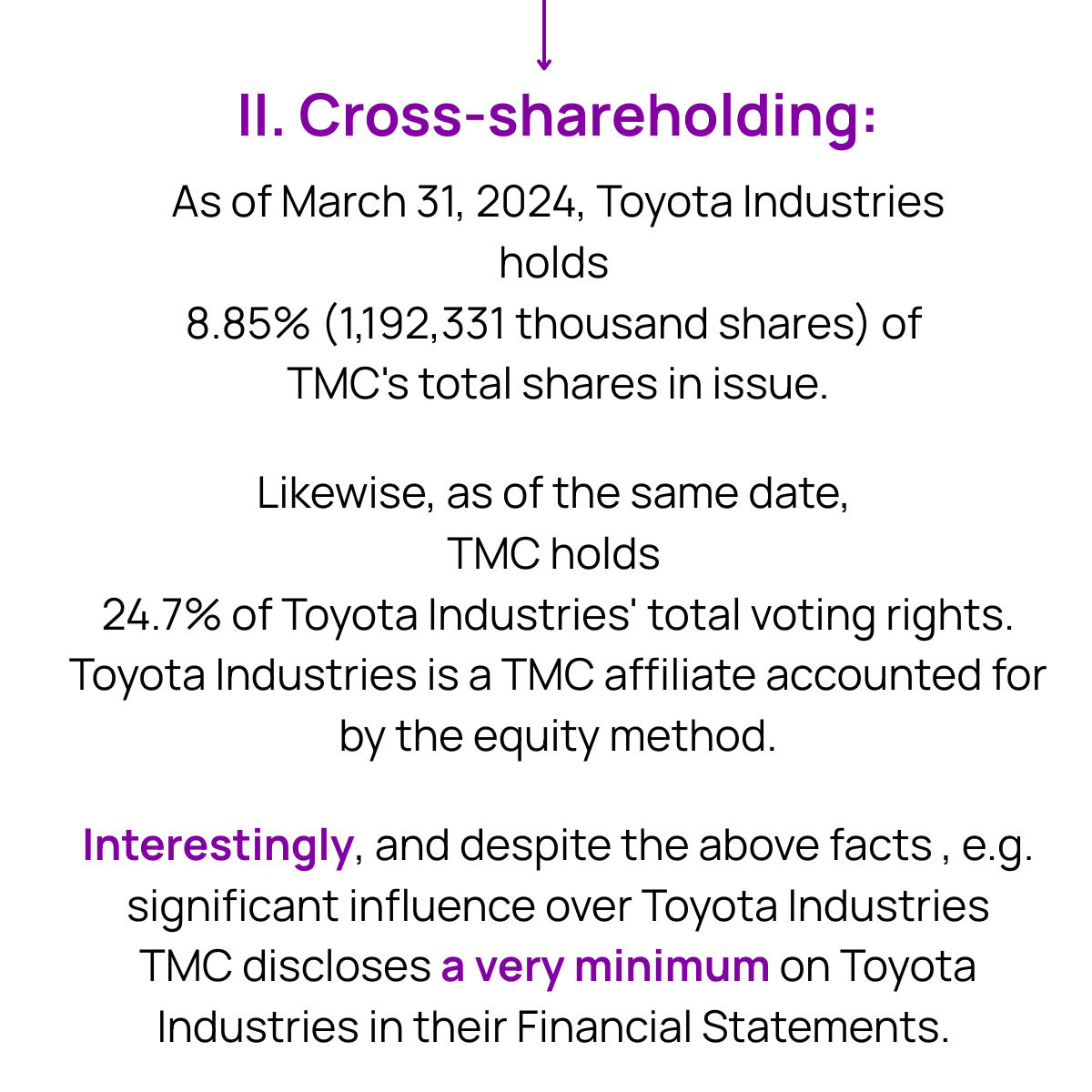

Just writing about the proposal I am wondering - is this really a movement towards simplification and transparency at the Toyota Group?

The bid is celebrated as a reform of the corporate governance in Japan.

Financial Times quotes an independent analyst saying: "There is minimal transparency for how advisers came up with the fair value of the bid. There are a lot of moving parts properly explained."

So. If you ever wondered what standards like IFRS 12 Disclosure of Interest in Other Entities are good for, this is the reason.

Definition of Keiretsu over Wikipedia. The system of Japanese keiretsu is described in the book: Keiretsu: Inside the Hidden Japanese Conglomerates by Miyashita, Kenichi, David Russel