IFRS 19 Subsidiaries without Public Accountability: Disclosures: The Who + Example

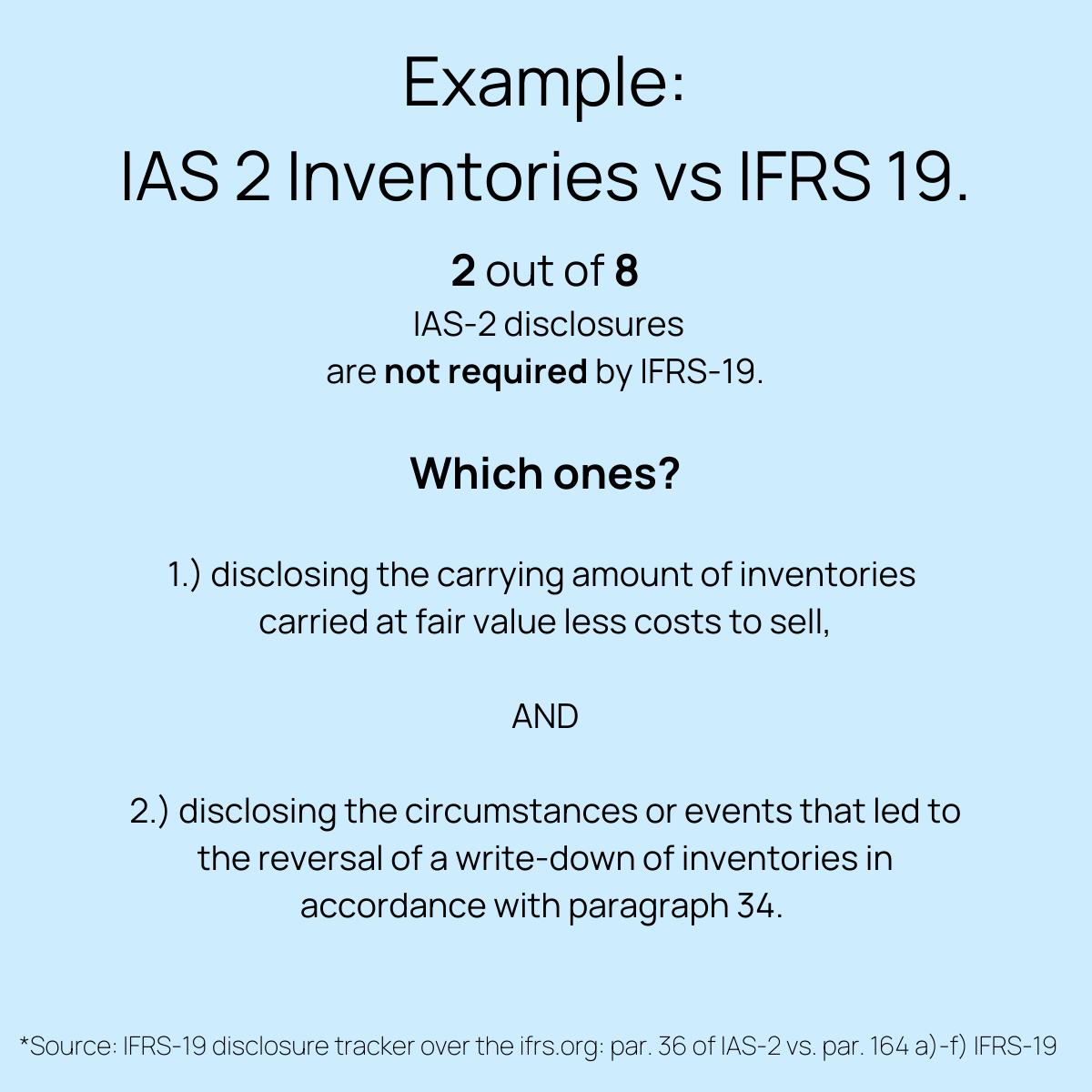

Example of a disclosure relief: IAS 2 Inventories.

Which entities are eligible for the disclosure relief under IFRS 19?

Let`s have a look both at the theory and at some practical application.

The IASB already allowed for a set of reduced disclosures within the IFRS for Small and Medium Enterprises.

To borrow the definition of an eligible subsidiary from the IFRS for SMEs was a good idea.

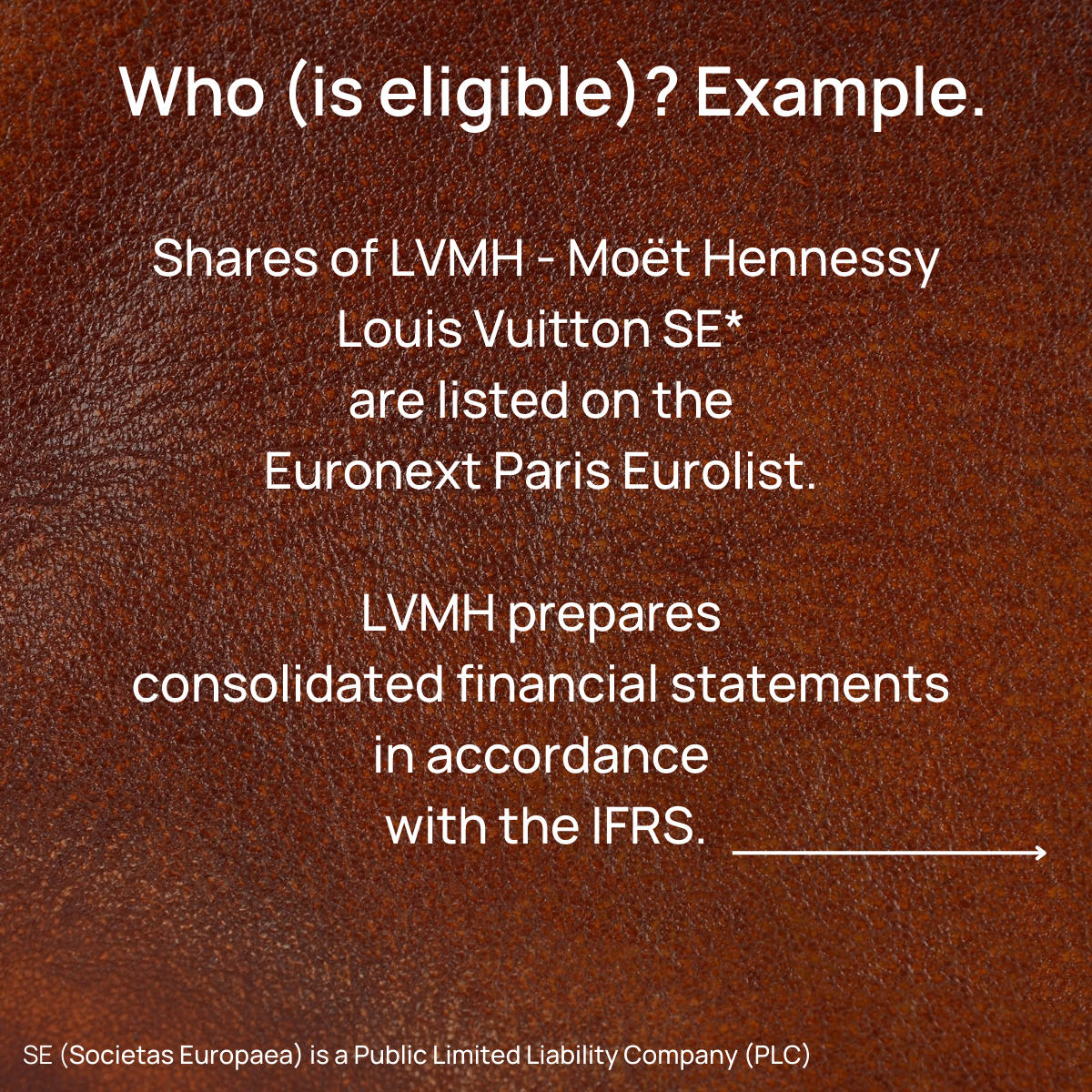

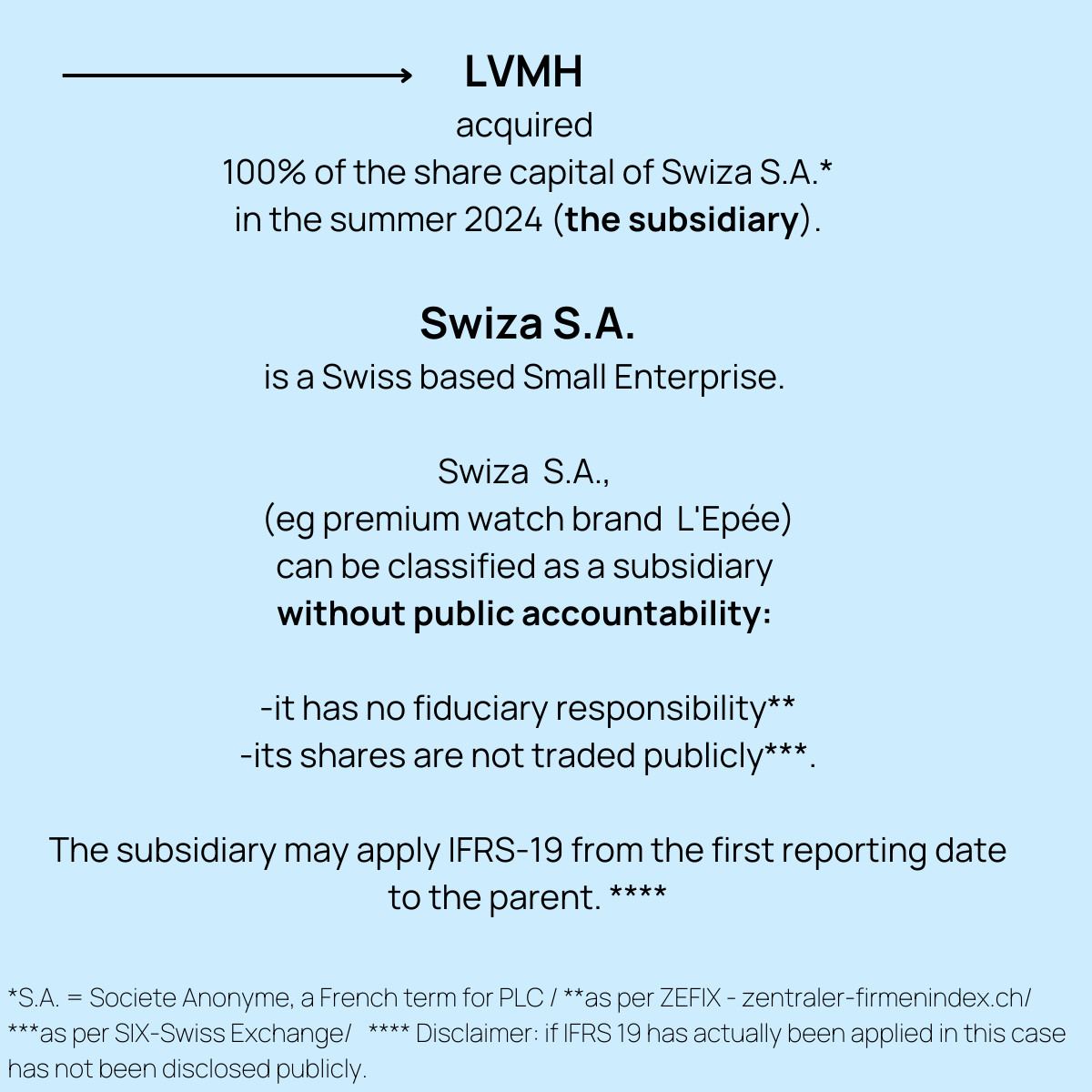

Disclosure relief under IFRS-19 can be applied by a subsidiary:

that does not have public accountability and,

whose parent prepares consolidated financial statements available for public that comply with the IFRS.

No public accountability can be ascertained when:

- Equity instruments of an entity – shares - are not publicly traded/ publicly quoted,

or

- An entity does not hold assets in fiduciary capacity.

Fiduciary capacity means the capacity of an entity of holding money or assets on behalf of someone else (typical for banks, investment funds, insurance companies).

❗However, holding money for a broad group of outsiders (clients, members) for reasons incidental to their primary business by eg:

🔹 schools,

🔹 charities,

🔹 membership organisations (fitness clubs, church organisations, "Vereine"),

🔹 travel agencies,

🔹 utility companies,

does not make those entities publicly accountable.

To see an example of applying the IFRS-19, just swipe to the right in the picture.⏩