IAS 27 Separate Financial Statements

IAS 27 applies to accounting and disclosure requirements for investments in subsidiaries, joint ventures and associates when an entity elects, or is required by local regulations, to present separate financial statements.

“Window dressing —measures taken by management to make the company appear as strong as possible in its financial statements.”

Today: a 15-second-overview of IAS 27 Separate Financial Statements.

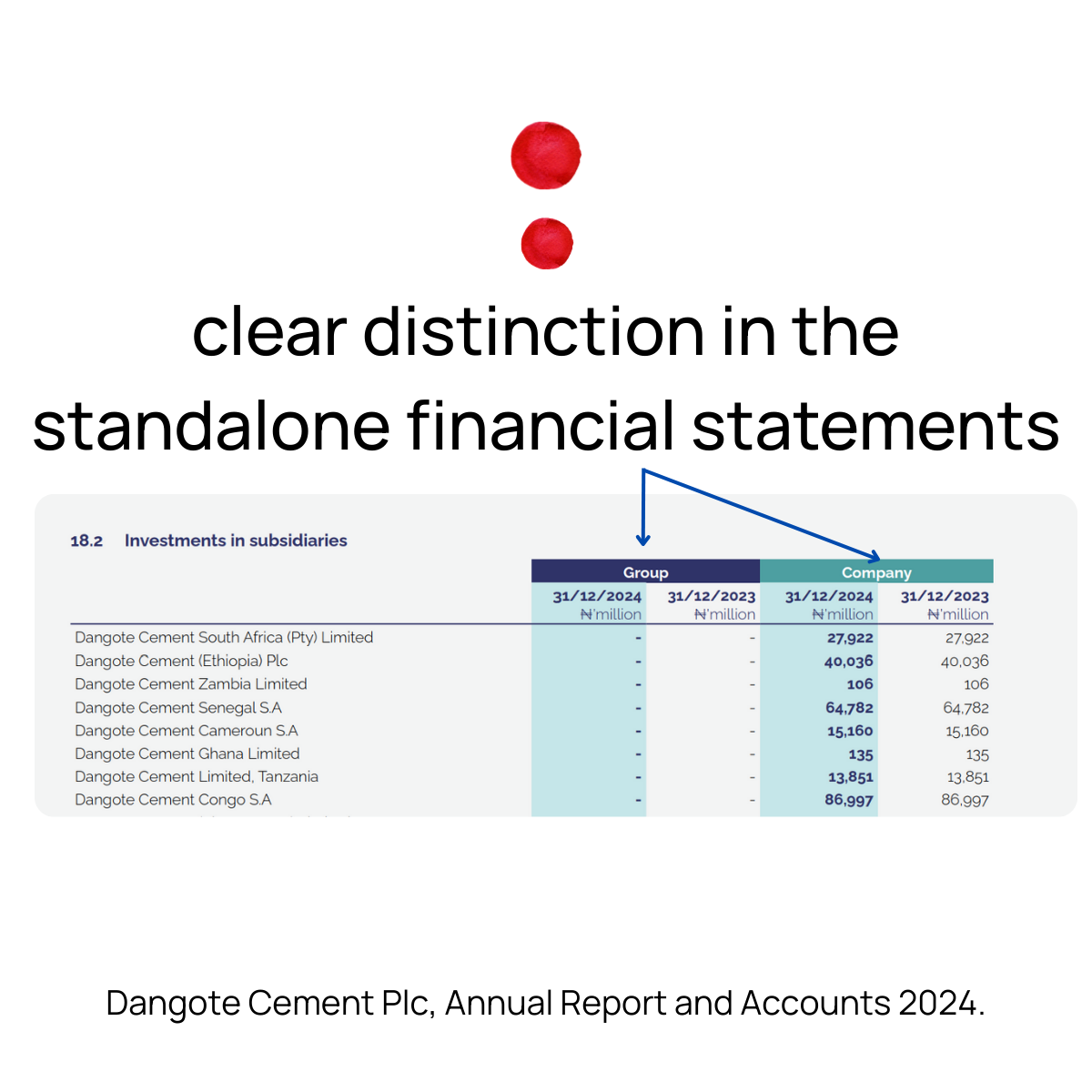

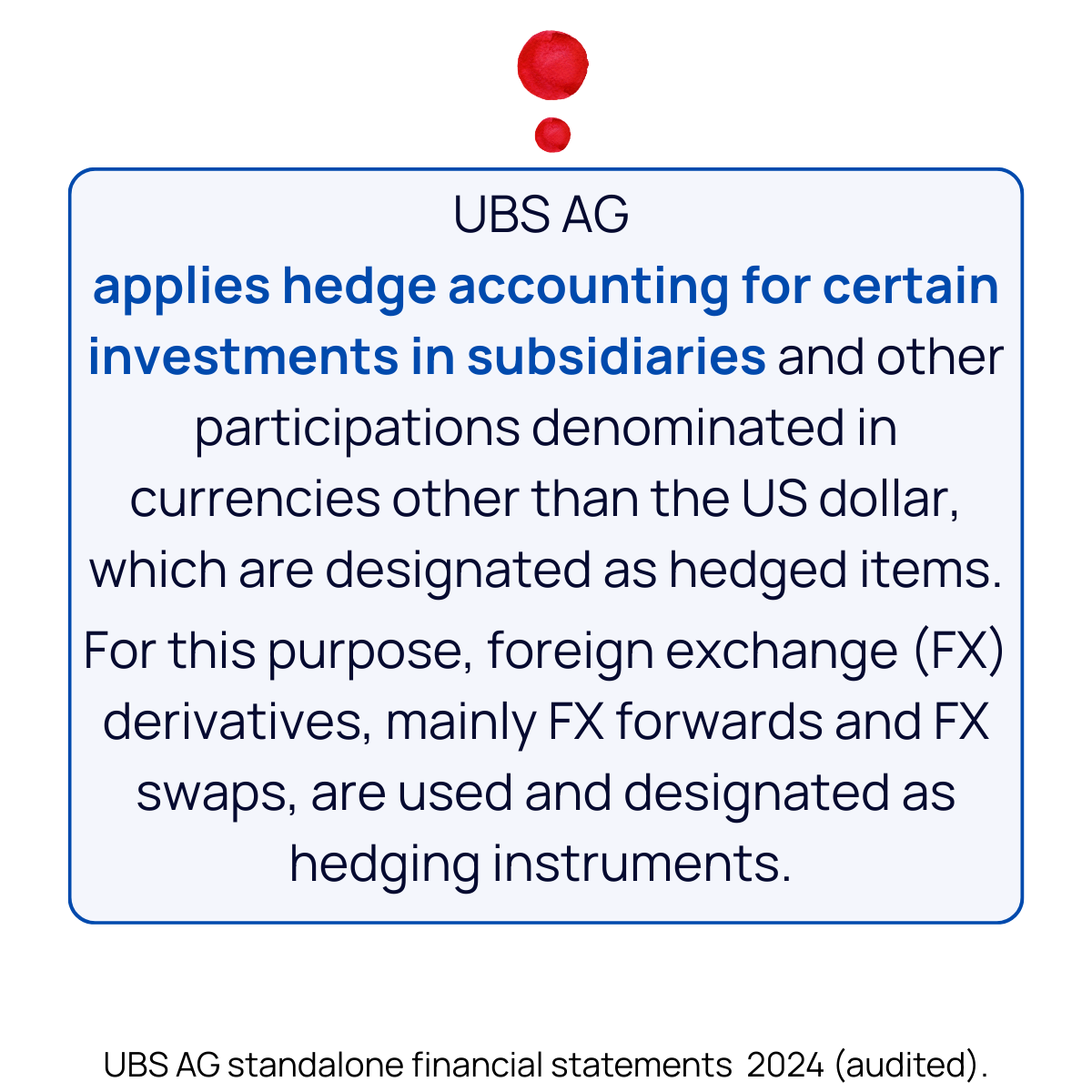

Focus: investments in subsidiaries, associates and joint ventures are in separate financials are shown at i) cost; ii) according to IFRS 9; or iii) applying at-equity consolidation (IAS 28).

Real life examples in the carousel.

📍 For your practice: A parent company can be relieved or opt out from preparing consolidated financial statements in accordance with the paragraph 4a) of IFRS 10 Consolidated Financial Statements.

If this company applies IFRS 19 Subsidiaries without Public Accountability it must disclose:

🔹 the fact that the financial statements are separate financial statements; that the exemption from consolidation has been used; and identification of name and principal place for consolidated financial statements;

🔹 a description of the method used to account for its investments in subsidiaries, joint ventures and associates.

IFRS 19, par. 238 a), b).

headline quote: Financial And Managerial Accounting by Jan R. Williams via Goodreads